Why Every Student Should Learn Banking With SimuBank Before Opening Their First Account

Most people learn banking by making expensive mistakes with real money. There's a better way.

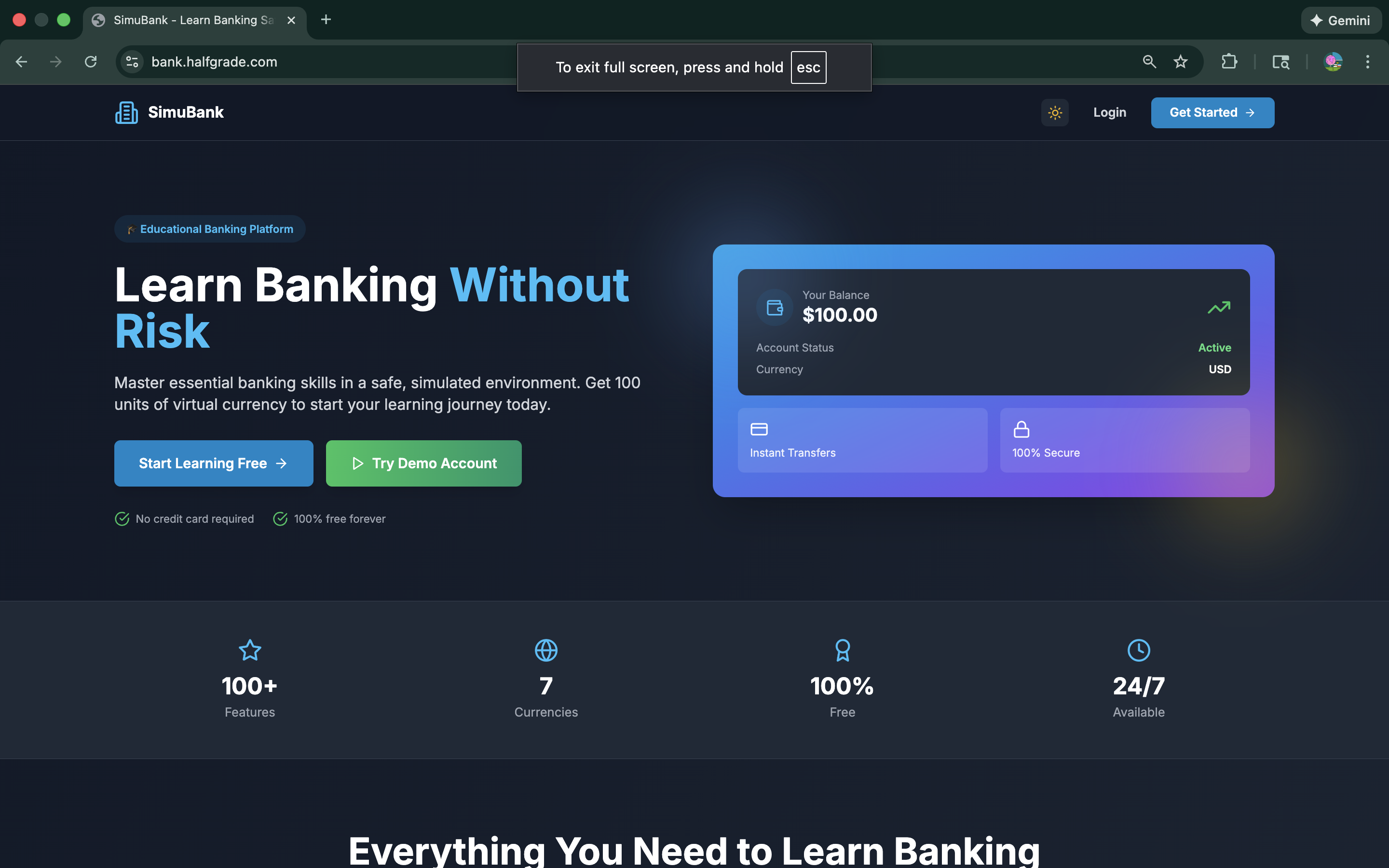

SimuBank Homepage - Learn banking fundamentals in a risk-free environment

Picture this: You're 18, heading to college, and your parents tell you it's time to open your first bank account. You walk into the bank, and suddenly you're faced with terms like "overdraft protection," "minimum balance requirements," and "monthly maintenance fees."

Sound familiar? Most people learn banking the hard way — through expensive mistakes, confusing fees, and trial and error with real money.

What if you could learn all the basics first, without any financial risk?

The Financial Literacy Crisis

Studies show that 60% of Americans can't pass a basic financial literacy test.

Only 21 states require high school students to take a personal finance course.

The average American pays $329 per year in banking fees — most of which are avoidable.

Enter SimuBank: Banking Education That Actually Works

SimuBank is an educational banking simulator that lets you experience key banking operations using virtual money instead of real funds.

It's not a real bank — there are no actual deposits or financial products with real money — but it closely mimics real banking functions so you can learn by doing.

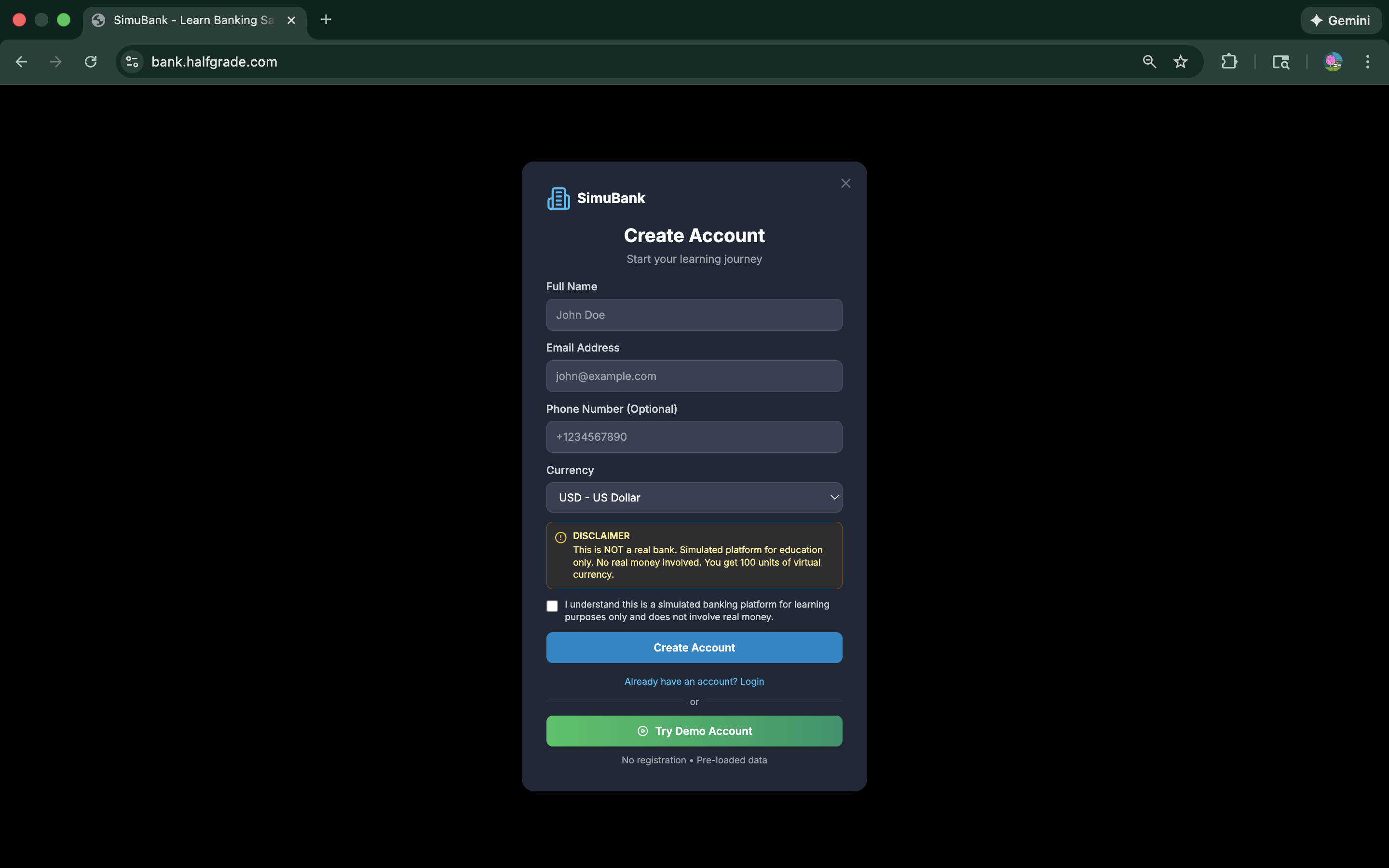

Simple login process - no complex setup or real financial information required

What SimuBank Actually Offers

Smart Account Management

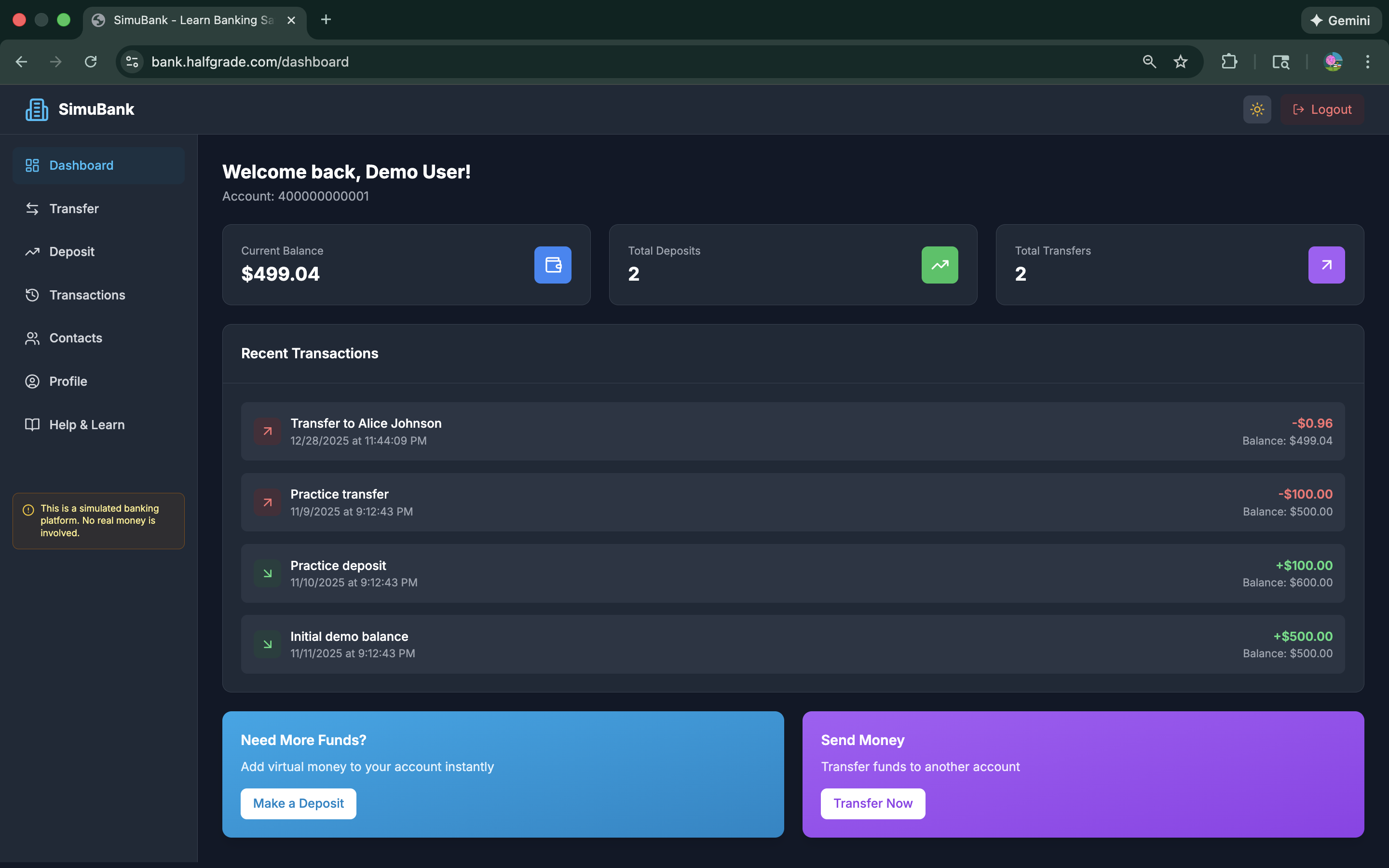

Clean dashboard interface showing account balances and recent activity

Learn to read and understand a banking dashboard just like you'd see at major banks. Track your virtual balance, monitor transactions, and understand how account information is organized.

This is where you'll learn the basics: What's a checking account? How do savings accounts work? What does "available balance" mean versus "current balance"?

Understanding Transfers and Transactions

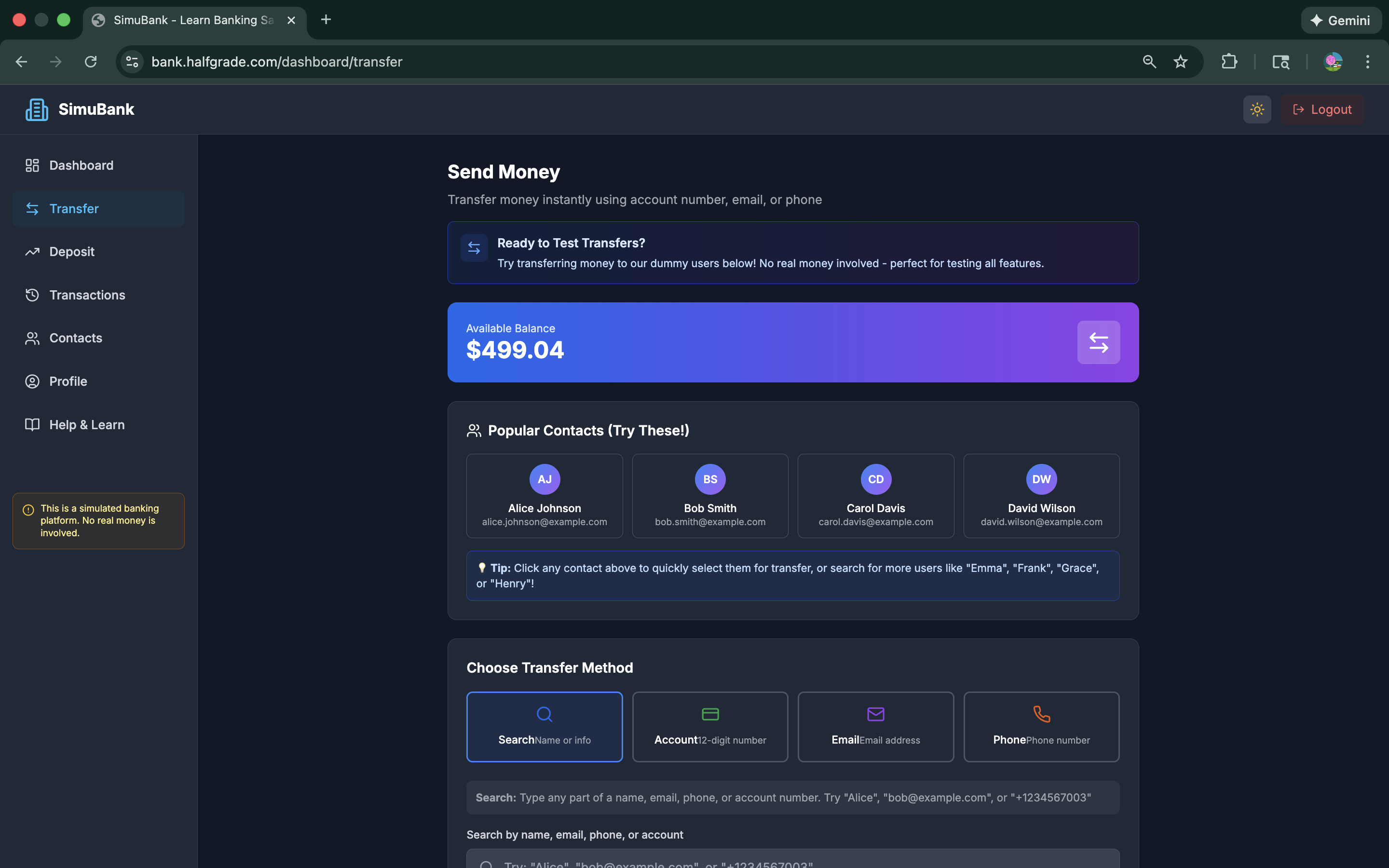

Practice money transfers without any real financial risk

Learn how money moves between accounts. Practice different types of transfers and understand the process without worrying about making costly mistakes.

- How to transfer money between your own accounts

- Understanding processing times and fees

- What information you need for different types of transfers

- How to verify transactions were completed correctly

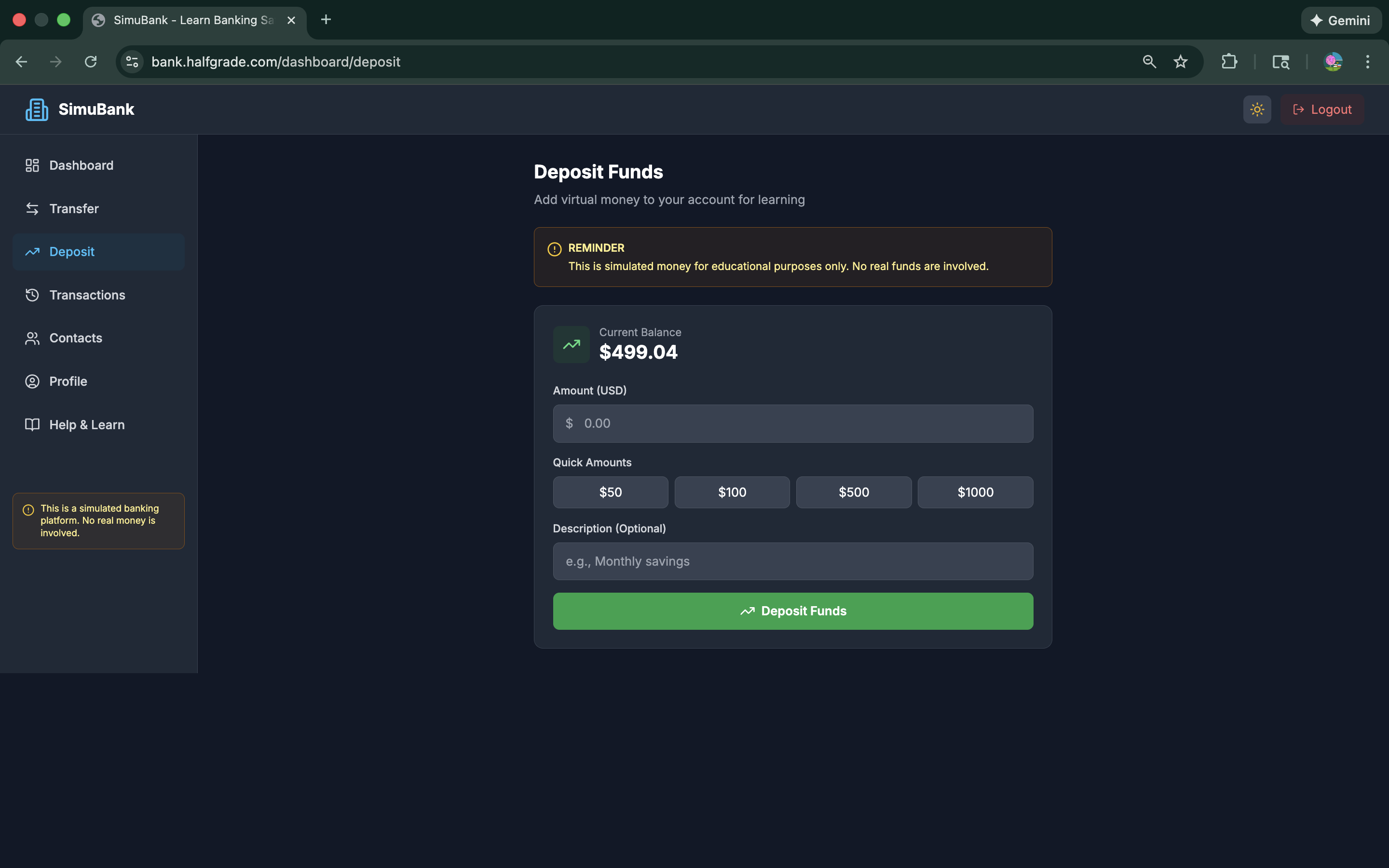

Deposits and Account Operations

Learn how deposits work and how they affect your account balance

Understand the different ways money can enter your account and how each method works:

- Direct deposits from employers

- Mobile check deposits

- Cash deposits at ATMs or branches

- Wire transfers and electronic payments

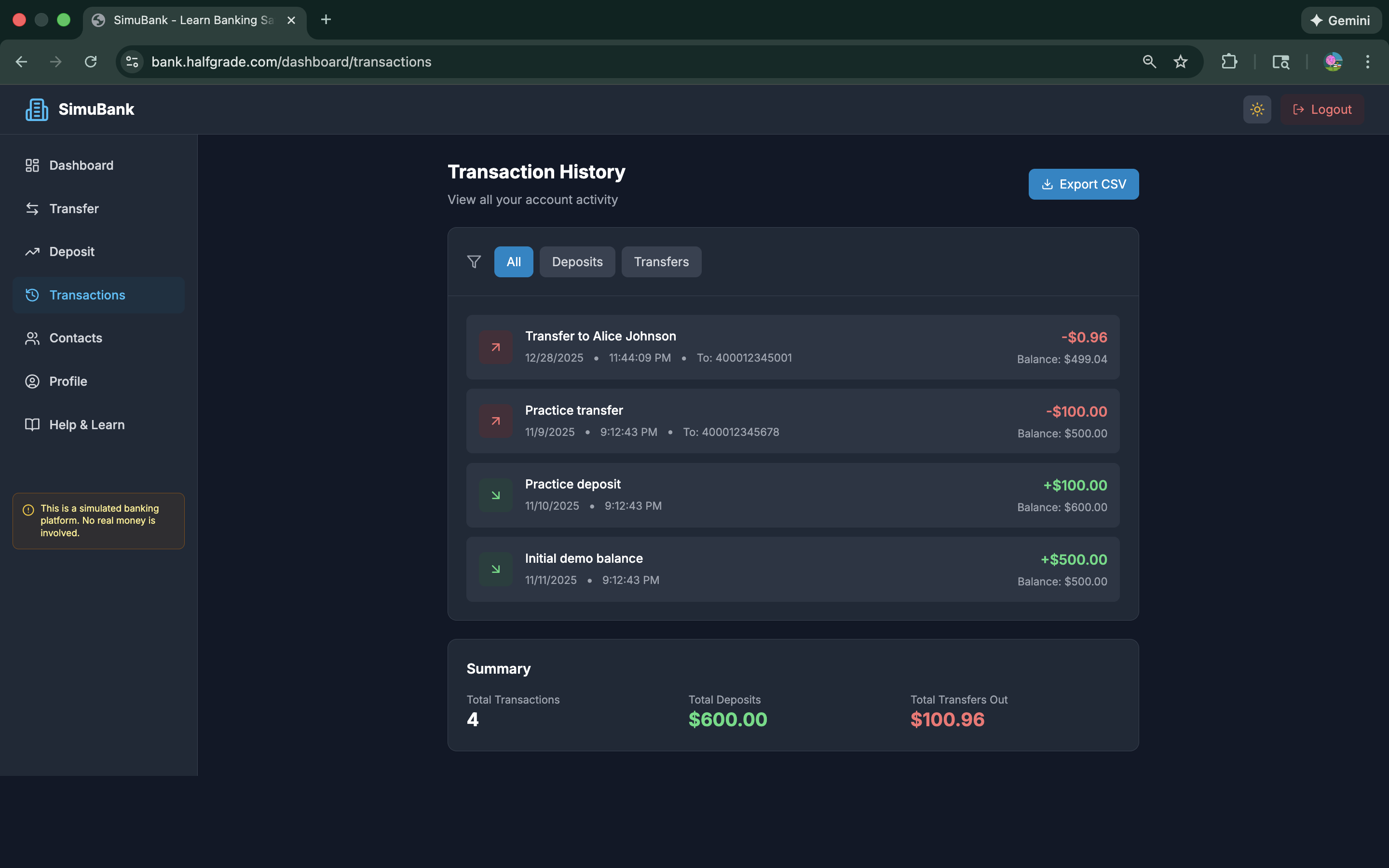

Transaction History and Record Keeping

Learn to read and understand your transaction history

One of the most important banking skills is understanding your transaction history. Learn to:

- Read and interpret transaction records

- Identify different types of transactions

- Spot unauthorized or incorrect charges

- Keep track of your spending patterns

- Reconcile your records with bank statements

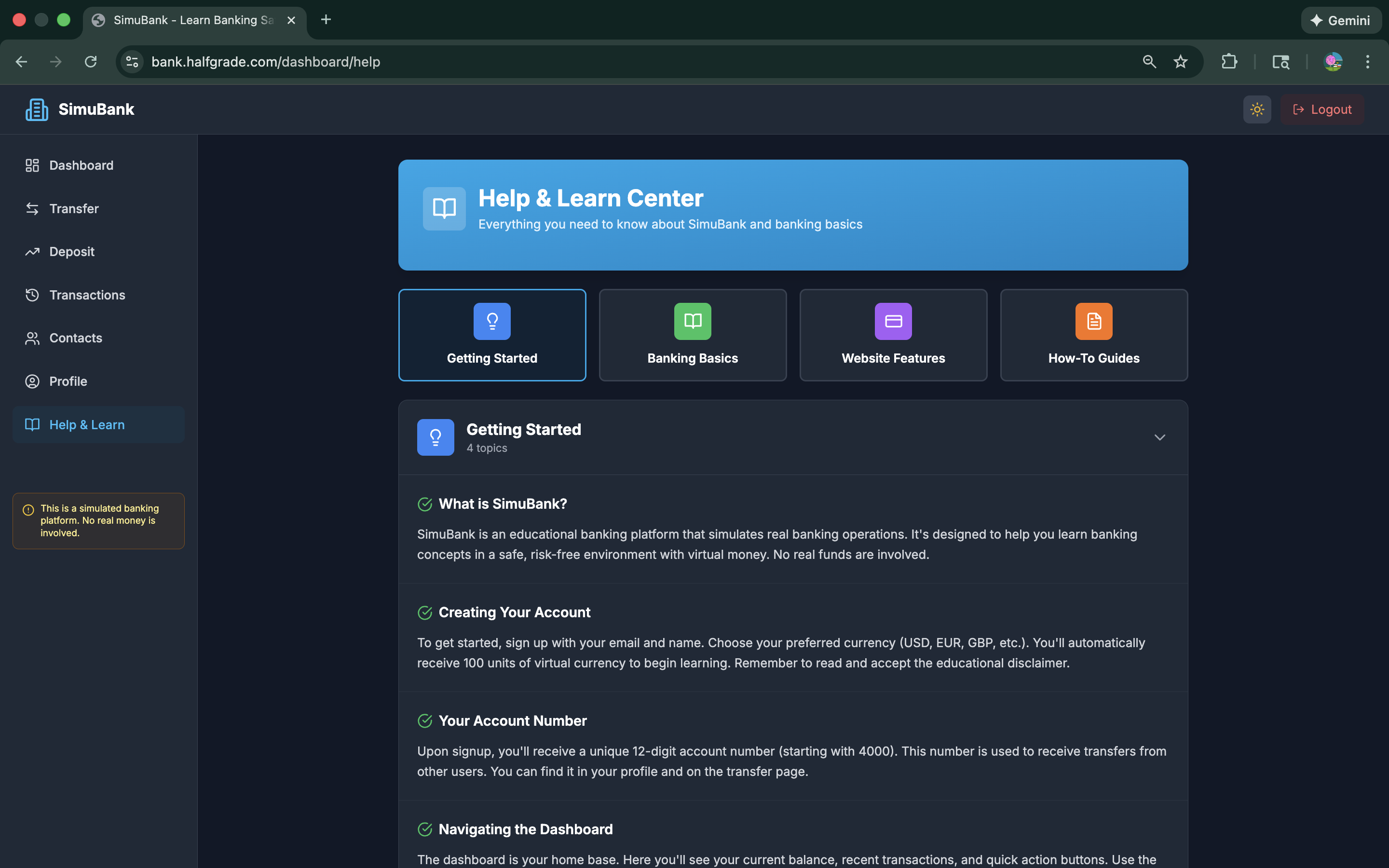

Banking Education and Resources

Built-in educational resources explain banking concepts clearly

The learning center explains fundamental concepts that every bank customer should understand:

- Different types of bank accounts and their purposes

- How interest works on savings accounts

- Understanding fees and how to avoid them

- Banking terminology and common terms

- Digital banking security and best practices

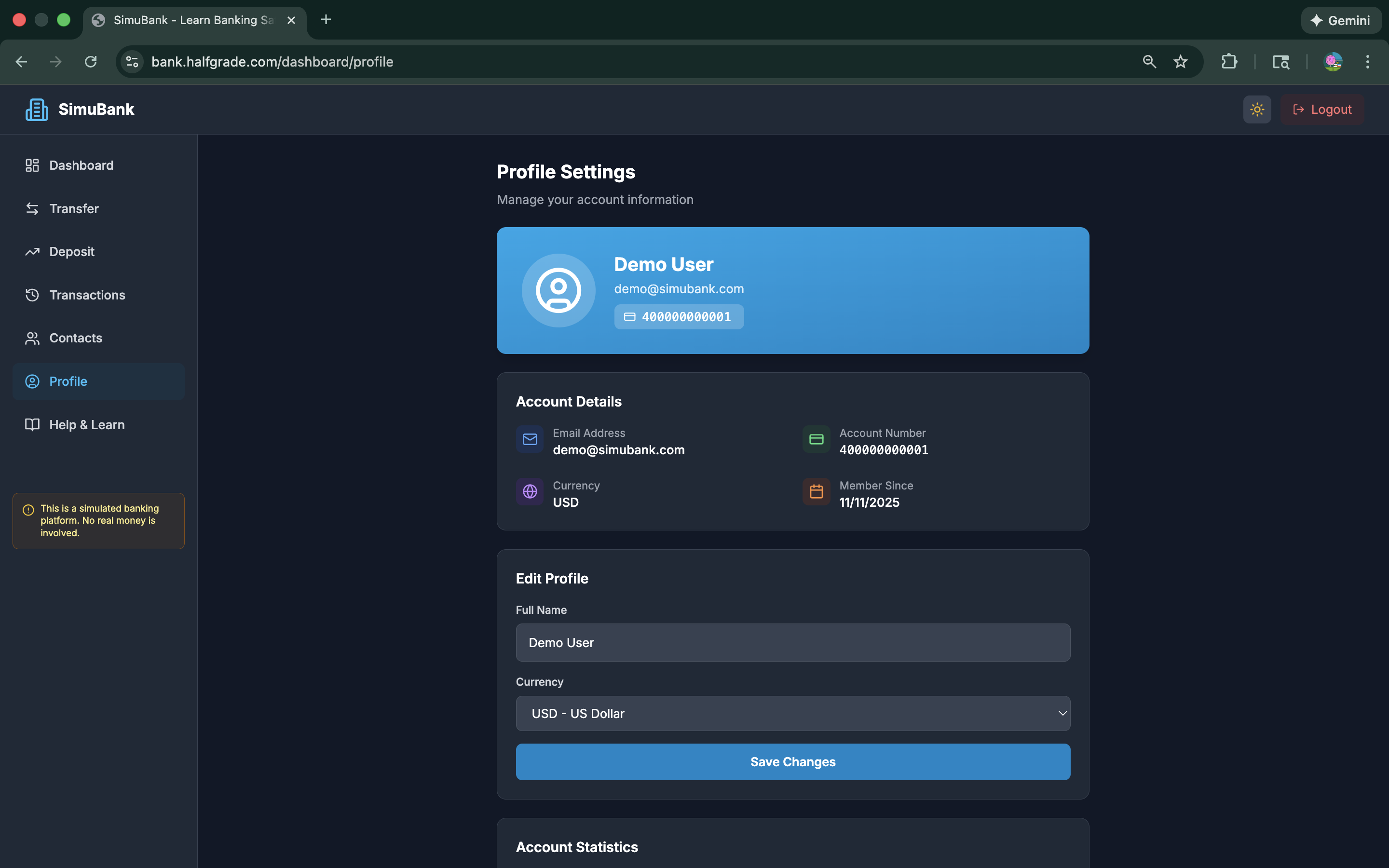

Profile and Security Management

Learn about account security and personal information management

Understanding how to manage your banking profile and security settings is crucial:

- How to update personal information safely

- Understanding banking security measures

- Setting up account alerts and notifications

- Managing privacy settings and preferences

What SimuBank Is NOT

Why Learning Banking This Way Makes Sense

Safe Learning Environment

Make mistakes and learn from them without any financial consequences. Practice until you feel confident.

Hands-On Learning

Learn by doing rather than just reading about banking concepts. Experience how banking actually works.

Build Confidence

Walk into a real bank knowing exactly what to expect and how everything works.

Who Should Use SimuBank?

High School Students

Learn banking basics before opening your first account.

College Students

Understand banking before managing student loans and part-time job income.

New Adults

Build financial literacy skills for independent living.

Educators & Parents

Teach financial literacy in a practical, hands-on way.

Getting Started with SimuBank

- 1. Visit bank.halfgrade.com and create your account

- 2. Start with your virtual balance (typically $100)

- 3. Explore the dashboard and familiarize yourself with the interface

- 4. Practice basic transactions like transfers and deposits

- 5. Use the learning resources to understand banking concepts

- 6. Review your transaction history and learn to read statements

The Bottom Line

Banking skills aren't optional in today's world — they're essential. But most people learn through expensive trial and error with real money.

SimuBank flips that approach. Learn first, practice second, then handle real money with confidence.

Whether you're a student preparing for financial independence, a parent teaching your children, or an educator looking for practical financial literacy tools, SimuBank provides a safe space to build real banking skills.

Ready to learn banking the smart way? Visit bank.halfgrade.com and start building your financial confidence today.