Why Every Beginner Trader Should Start With Paper Trading

Most people don't lose money in trading because they lack intelligence. They lose money because they learn with real money.

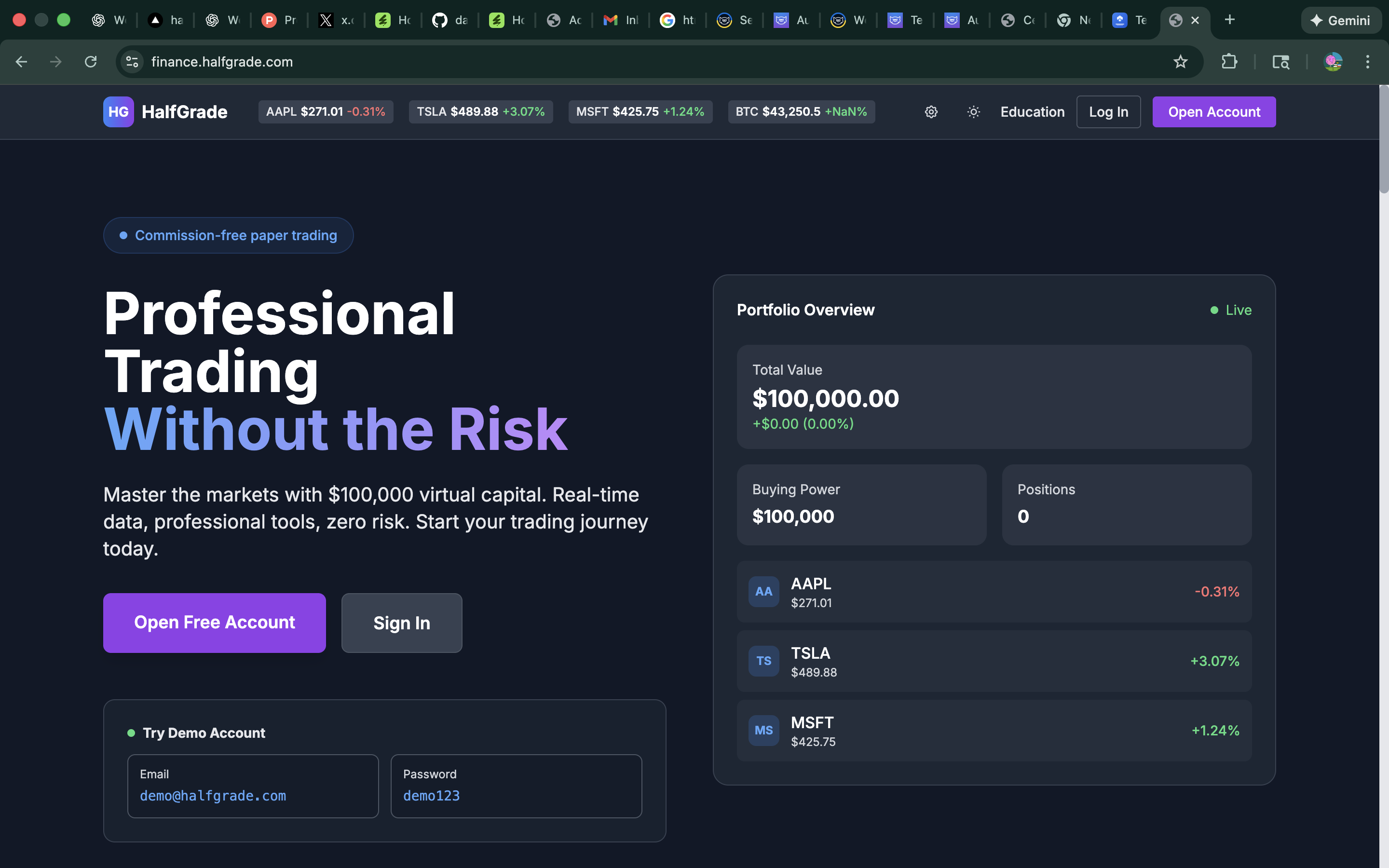

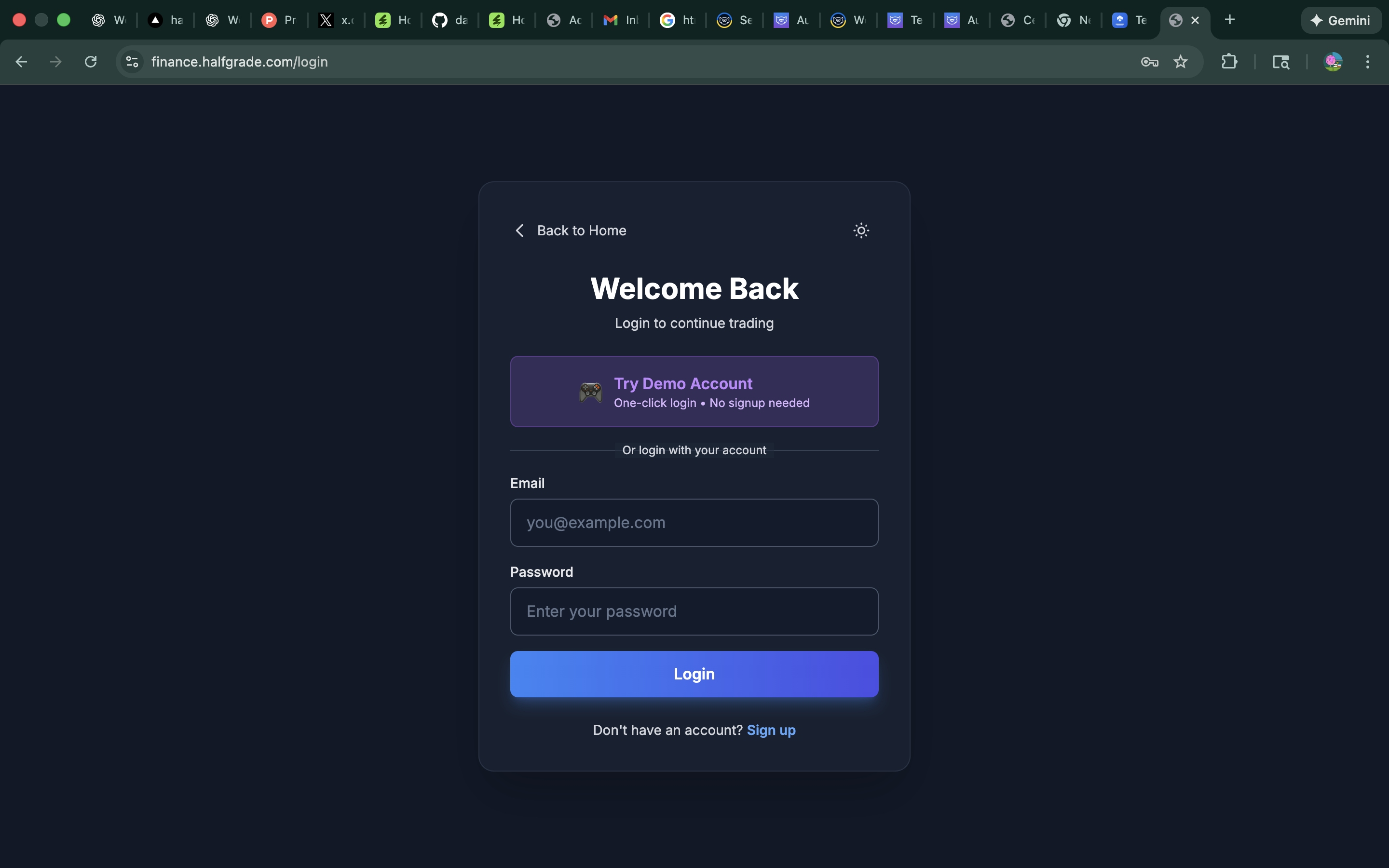

HalfGrade Finance - Practice trading with virtual money in a realistic environment

Charts look simple. Buy and sell buttons look harmless. But once real money is involved, emotions take over — fear, greed, hesitation, regret. That's when mistakes become expensive.

Before risking a single dollar, I wanted to understand how trading actually works. That's when I explored paper trading — and one simulator that stood out was HalfGrade Finance.

What Is Paper Trading?

Paper trading is a way to practice trading using virtual money instead of real funds.

You place trades, track profits and losses, and experience market movement — but nothing is at risk. No real money, no real losses.

Simple access to paper trading - no account funding or real financial exposure required

This approach has been used for decades by professional traders, students, and investors to:

Platforms like HalfGrade Finance bring this experience into a simple, accessible web simulator.

What HalfGrade Finance Actually Does

HalfGrade Finance is a trading simulation platform, not a real brokerage.

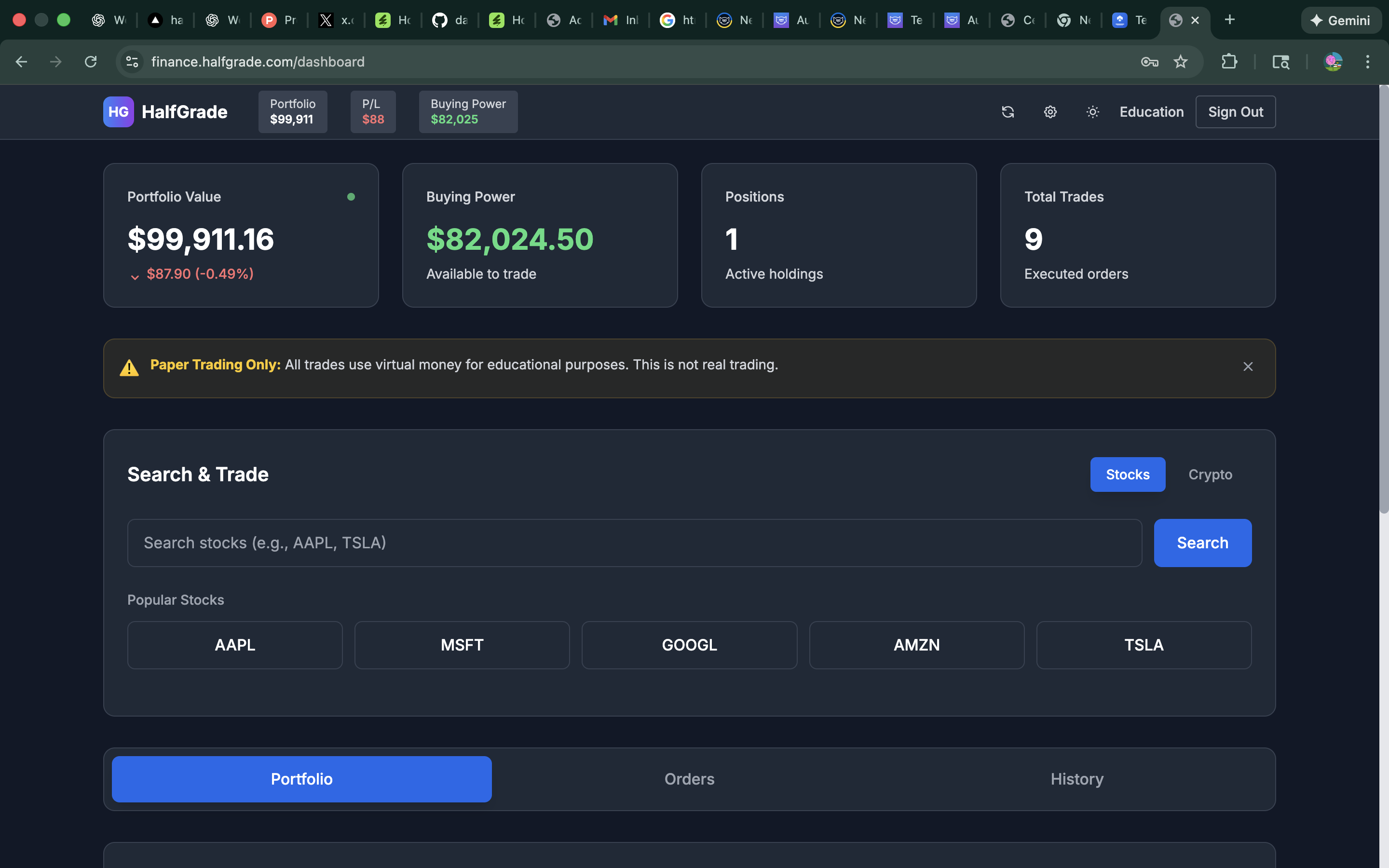

It allows users to:

- Practice buying and selling assets using virtual capital

- Observe how prices move and how trades affect a portfolio

- Learn trading basics in a realistic but risk-free environment

Real market data and price movements without the financial risk

There's no account funding, no real deposits, and no real financial exposure. Everything happens inside a simulation — which is exactly the point.

Why Learning This Way Makes Sense

1. You Learn Without Fear

When there's no real money involved, decision-making improves.

You focus on:

- Why a trade worked

- Why a trade failed

- How timing and price movement matter

Instead of panicking over losses, you analyze them.

2. You Understand Market Mechanics

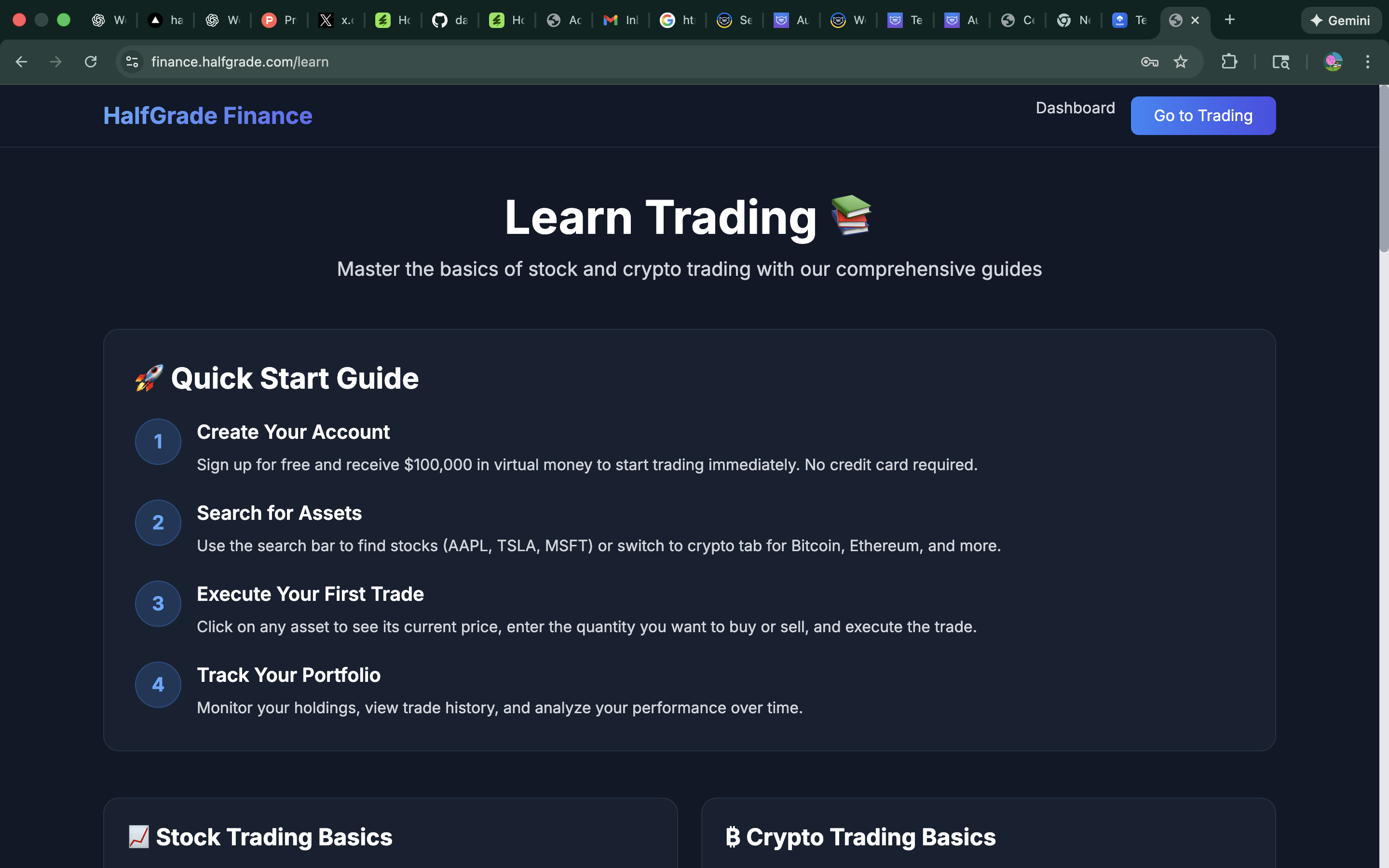

Educational resources help you understand the 'why' behind market movements

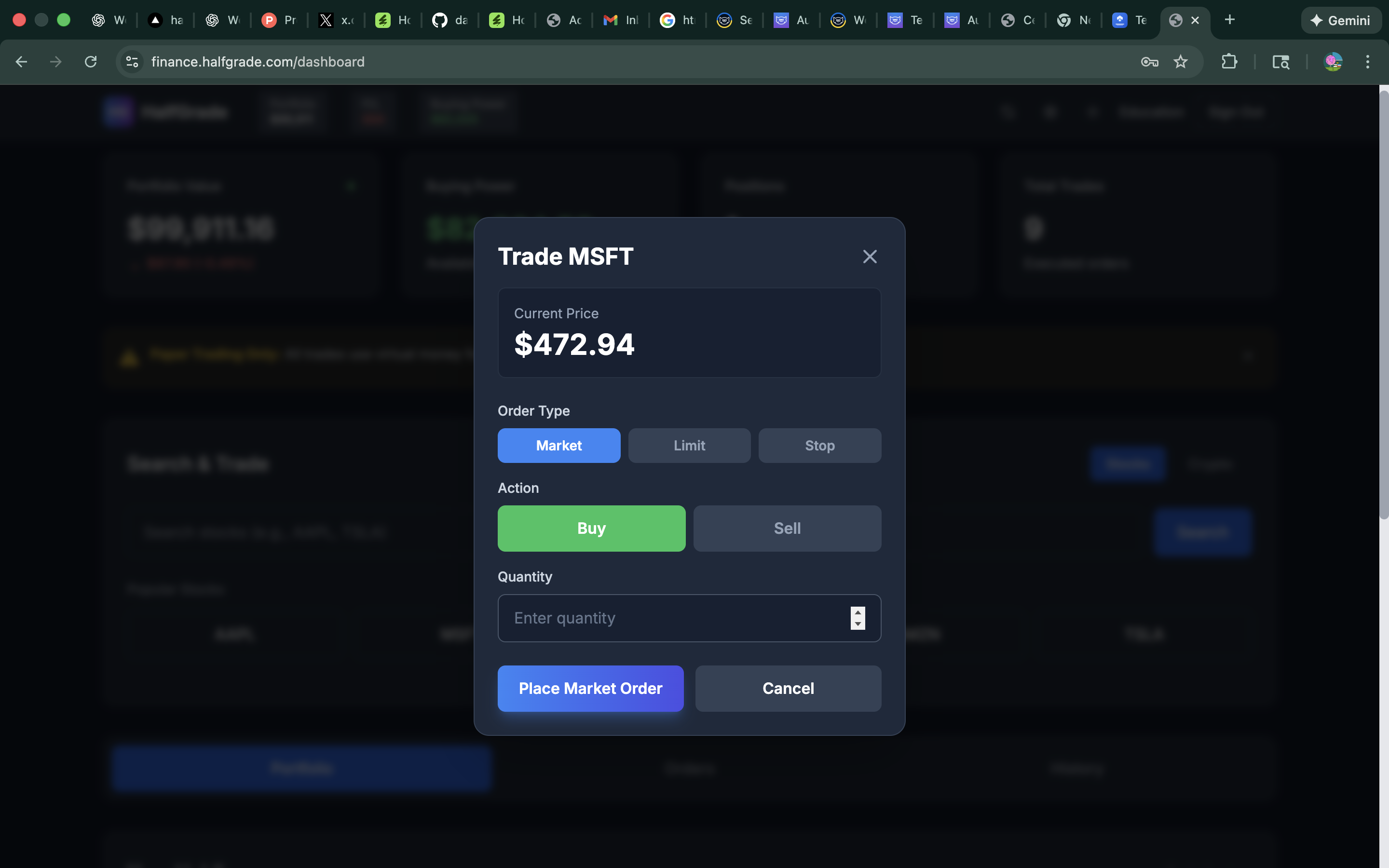

Paper trading helps you understand:

- How buy and sell orders work

- How price changes impact positions

- How gains and losses accumulate over time

These are things many people only learn after losing money in live markets.

3. You Can Test Ideas Safely

Want to try a new strategy? Curious how a market reacts to volatility?

Paper trading lets you experiment freely — without consequences.

It's one of the safest ways to develop discipline and consistency before moving to real trading.

Simple login process - no complex account setup or funding requirements

What This Platform Is Not

It's important to be clear.

HalfGrade Finance:

It's a learning and practice tool, designed to help users understand trading concepts before entering real markets.

Who This Is Useful For

This kind of simulator is especially helpful for:

If you've ever felt overwhelmed by trading platforms or afraid to start, paper trading is a logical first step.

A Smarter Way to Start Trading

Most trading mistakes happen early — when people jump in too fast with real money.

Paper trading flips that approach:

- Learn first

- Practice second

- Risk money later

Platforms like HalfGrade Finance make that process simple and accessible.

If your goal is to understand trading before paying for mistakes, starting with a simulator is not just helpful — it's smart.

Getting Started

Ready to begin your paper trading journey?

- Visit HalfGrade Finance: Go to finance.halfgrade.com

- Create your account: Simple signup process, no funding required

- Start with virtual money: Begin practicing with simulated capital

- Focus on learning: Use the educational resources to understand market concepts

- Track your progress: Analyze your trades and learn from both wins and losses

- Build confidence: Practice until you feel ready for real market conditions

Remember: The goal isn't to make virtual profits. The goal is to understand how trading works, develop good habits, and build the confidence you'll need when real money is on the line.

💡 Key Takeaway

Paper trading isn't about making money — it's about learning how not to lose money. Master the basics in a risk-free environment before putting your capital at risk.